Discover more from CrowdCent Curation

CrowdCent Curation - No. 47

Inflation-Adj. Investment Returns, Evolving Financial System, & Autonomous Robots

Hope everyone is doing well! With the launch of a few new products, we had to reassess and refresh our newsletter – now we’re back. And just in time for some exciting technological developments and market volatility. Enjoy the content below, and join us for a live discussion via Spaces on Tuesday (5/7).

Tuesday (5/7) we’re hosting a Twitter (X) Spaces at 11:00am ET - join us CrowdCent Curation - Live!

The discussion will focus on the content below — notably, our updated Macro views, along with an update on the rapidly changing AI Landscape

After a few years of strong results, SZ Strategies (launched in early 2020) has now been phased out in favor of a live strategy

High level - we use our quantitative models (powered by cutting-edge AI & NLP technology) to select ideas from SumZero's vast database of investment research

For more information, feel free to email us

CrowdCent Alpha - ChatGPT meets Warren Buffet. An investment ‘oracle’ in many ways, and eventually an essential tool in every investor’s toolkit. Available now - email us for early access

Join our Telegram chat & follow us on Twitter for our latest thoughts & updates

“That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.” - Aldous Huxley

Translation: Most are aware of history. Few choose to actually study it and understand it. And even fewer actually learn from it and act on it. Thus, most expect it is ‘different this time.’ And the outcome is a consistent cyclical pattern – across markets, business, society, technology, etc. Today, we are in the midst of a 4th Turning – most can feel the change, but can’t put their finger on what is going on. Looking at history, it’s following a similar path to prior cycles – with today most closely resembling the 1940s. But like with any cycle, it is not identical, it simply offers a pattern to study to help prepare… Tune in to our Spaces to hear and discuss more.

Finance

Lyn Alden: April 2024 Newsletter: Balanced Portfolio Construction [Article]

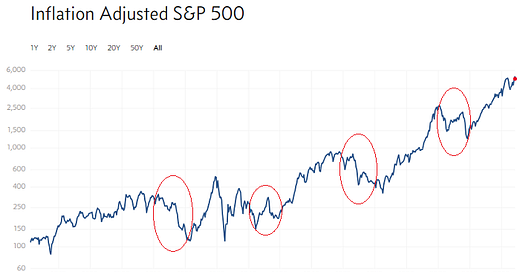

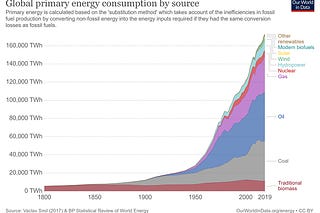

Recap: Lyn Alden's April 2024 newsletter discusses portfolio management in a time of shifting economic conditions, focusing on the traditional 60/40 portfolio (60% stocks, 40% bonds). Alden critiques the portfolio's efficacy in non-disinflationary environments, noting its historical underperformance during high inflation periods. She argues that the traditional bond-stock mix may not yield as strong returns in future decades due to changes in interest rates and inflation patterns. Alden suggests alternative investment strategies, including diversification into commodities and hard assets, to better hedge against inflation and provide more robust portfolio resilience. To take it a step further, in Lyn’s article Most Investments are Bad, she explores the idea that the majority of investments don't beat inflation significantly over the long term. Alden argues that many investments can seem appealing due to temporary market conditions or hype, but they often fail to deliver substantial real returns when adjusted for inflation. She emphasizes the importance of selective investment based on thorough analysis and historical performance, suggesting that investors focus on assets that have demonstrated durable value and resilience over time.

Comment: Most people do not look at ‘real world’ inflation-adjusted returns. And even fewer people look at investment returns adjusted for monetary debasement. As we are seeing today, and as is typical of 4th Turnings, inflation has become an issue – something we highlighted as highly likely in our predictions back in early June 2020, which are worth checking out (along with the updates). Overall, we continue to expect this decade (2020+) to be very different from the disinflationary past decade+ – which was helped by cheap labor in China and cheap energy from Russia. And we think everyone should be keenly aware of this new regime…

Blockchain

The Rise And Fall Of The Age Of Debt | Russell Napier [Podcast]

Recap: Russell Napier paints a picture of a global financial system at a crossroads, where significant policy shifts in Asia could have ripple effects worldwide, influencing everything from currency values to investment strategies and economic growth. He forecasts significant changes in Asian monetary policy, potentially as transformative as the end of the gold standard, with China possibly adopting a more flexible exchange rate system away from its historical practice of tightly controlling the yuan. In Japan, ongoing efforts to control interest rates through yield curve control could impact the yen and overall economic stability. Napier also highlights the broader implications for global financial stability due to high levels of debt in major economies, including the U.S., and suggests that these changes might provoke notable market reactions in assets like real estate and stocks. He advises investors to remain vigilant and adapt to potential deep structural changes in the global financial system, which could necessitate new investment strategies.

Comment: As is typical of major 4th Turnings, systems and institutions change. The financial system is no different, and we are seeing major changes across the world – from multi-polar currency trading net settling in gold, to decentralized parallel systems fighting for legitimacy. On the margin, a more multipolar system should be healthy and should allow the US to reindustrialize – which is critical after decades of offshoring, particularly in an era of rising geopolitical tensions (check out David Murrin’s latest for more here). But we must recognize the new world we are in, embrace change and harness innovation to build something better on the other end…

Technology

Josh Wolfe: The ChatGPT of Robotics is Coming [Podcast]

Recap: In this podcast, Josh Wolf focused on the transformative potential of robotics and AI in various industries, emphasizing the challenges and advancements in robotics due to the lack of extensive real-world training data. The discussion highlighted how technological development could leapfrog through innovative designs that optimize functionality over mimicking human forms. The episode also addressed the dominance of incumbent companies like Amazon and Google, which have significant advantages due to their extensive resources and data, posing barriers to startups that, despite these challenges, continue to drive innovation. Looking forward, the integration of AI and robotics into daily life raises ethical and practical considerations regarding employment, privacy, and societal norms.

Comment: It wouldn’t be a Curation without an update on LLMs and AI. We continue to harness the latest tech in our own pipelines, which, at the moment, don’t have anything to do with real-world robots. But it’s always exciting to see progress in the physical robotics space – from Waymo ramping up its service coverage area in the US, to Auto OEMs scaling robots in manufacturing, to drone deliveries coming to a town near you. AI overall is a technological revolution, and the implications will be far-reaching and hard to fathom today… It’s already amazing to see the progress and the Cambrian explosion has just begun…

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

CrowdCent Alpha - ChatGPT meets Warren Buffet. An investment ‘oracle’ in many ways, and eventually an essential tool in every investor’s toolkit. Available now for early access…

SumZero partnership - this CC thread + SZ thread provide great summaries of the collaboration. Check out the video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in an earlier Curation

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com)

CrowdCent Thoughts & Predictions

Check out below for thoughts on the next decade. These thoughts continue to build upon our previous predictions, which you can find below:

CrowdCent Site Updates

Check out the new site

Any suggestions, send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason, Ryan, & Carlo

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Disclaimer: The content provided in the CrowdCent Curation newsletter is for informational purposes only and does not constitute financial, investment, or other types of advice. The opinions expressed are those of the individual contributors and do not necessarily reflect the official policy or position of CrowdCent. Readers should not rely solely on the information presented here and should conduct their own research and consult with professional advisors before making any investment decisions. CrowdCent accepts no liability for any loss or damage arising from any reliance on the information contained in this newsletter.

For the full disclaimer see https://crowdcent.com/legal/

Subscribe to CrowdCent Curation

Curated content across Finance, Blockchain, and Technology