Discover more from CrowdCent Curation

CrowdCent Curation - No. 43

The End of a System, Meaning of Money, Popping Bubbles, & Updated Thoughts

Hope everyone is doing well! Apologies for the hiatus, we’ve been focused on building in the background and have a bunch of new products on the way. Enjoy the updated content and thoughts below, and have a great long weekend!

Active discussion - chat

CrowdCent on Twitter - link

CrowdCent Vision - here

CrowdCent ML Model - analyzer

CrowdCent Curation - archive

“Prediction depends on events outside your control. Creation depends on events within your control. Don't guess about the future. Shape it.” - James Clear

Translation: If you want things to improve, make it happen. Hope is not a strategy.

Finance

Grant Williams Podcast: Luke Gromen [Podcast]

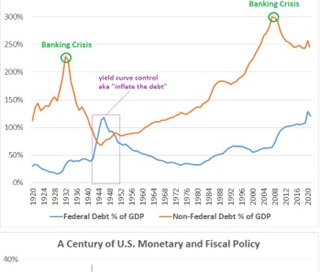

Recap: Luke provides useful context on the financial system backdrop (heavily leveraged system, Central Banks tightening into a slowdown to fight inflation) as well as how geopolitics ties in – Russia’s invasion of Ukraine was ‘well-timed,’ with the West already heavily indebted (just printed trillions to battle ‘COVID’) and attempting to tighten (despite economic slowdown) to fight inflation (from all the fiscal stimulus that was injected into a supply-constrained economy). You cannot take Russian oil off the market without severe disruption to the global economy and subsequent inflationary pressures. And the West cannot afford much higher interest rates given how leveraged the system is. It’s a tough conundrum for Central Banks, and right now they are playing with fire – but clearly opting for tightening into a slowdown until ‘something breaks.’

Comment: His big picture view is helpful in providing background on where we are at in the shorter and longer term cycles. We generally agree with his point that Central Banks will eventually HAVE to pivot to preserve the current system. We just believe the Fed is currently happy with the reverse wealth effect (recall, Fed officials sold their stocks in Sept. 2021) and are trapped a bit longer (~4Q22) given high and sticky inflation – which we called out in our June 2020 predictions: ‘After decades of no inflation, we will start to see real world inflation (not just financial asset inflation, which central banks have driven for 20+ years) in 2021+ driven by localization + government printing + commodities.’ On the inflation point, this short video is a must watch and this quarterly letter provides great commentary on how to invest in the upcoming inflationary decade. This all fits nicely with our original predictions, and the general end of the long term debt cycle (popularized by Dalio) as well as the 4th Turning transition (Howe) that we are currently undergoing.

Blockchain

What is Money, Anyway? [Post]

Recap: Lyn walks through the history of money (a term rarely defined or thought about in the US) and monetary systems, with a particular focus on the system we’ve been in for the last ~50 years (Petrodollar system, since dropping the gold backing) and how unusual it is. And she closes with thoughts on the future – specifically how blockchain (potential to be the underlying base layer tech) and digital assets fit in.

Comment: For a great summary of the post, check out this thread. This all ties in nicely with the above interview with Luke, as it’s important to understand the historical context of the monetary systems as we approach the end of this one – particularly as inflation becomes a more persistent issue (and devalues your real world purchasing power). Overall, a great piece that provides a unique perspective on how to view “money” and your resources (which you can consume, save, invest, or share) – money as an abstraction and a way to store energy. This (and Luke’s piece) ties in nicely with our original predictions from 2020, which we update below.

GPT3: The United States is no longer the biggest commodity importer, and its share of global GDP continues to decrease, which makes the existing petrodollar system less tenable. If several large fiat currencies can be used to buy oil, then the model looks more like a regional approach (and many tertiary currencies would manage themselves relative to these main currencies that have the scale and influence to buy oil and other foreign goods). If a major scarce neutral reserve asset (e.g. gold or bitcoin or digital SDRs or something along these lines, depending on your conception of where trends are going over the next decade or two) is used as a globally-recognized form of money, then a decentralized model can also look like this. Overall, it's clear that the trend in global payments is towards digitization and decentralization away from one single country's currency, but it's unclear precisely how the next system will turn out and on what timeline it will change.

Technology

The Popping of the Bubble Stocks: An Update [Post]

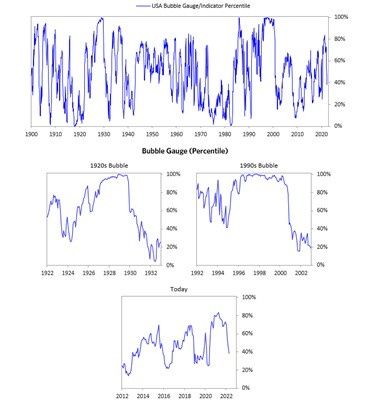

Recap: Dalio provides great historical context on past liquidity-induced market bubbles, and highlights where he believes we are today. His bubble gauge indicator is a useful metric, and highlights we have removed a lot of the froth, but we haven’t reached the other extreme (low end) quite yet.

Comment: Great template for identifying bubbles, as well as a ton of useful charts to quickly understand where we’ve been and where we are likely to go. For a similar macro-type read, check out Oaktree’s memo. Overall, we incorporate a lot of these metrics into our own modeling and hence why we called out the ‘liquidity bubble’ peak in ~Feb-Mar 2021 (details below) – since then, liquidity-driven things like ARKK are down ~75%. There is likely more to go until the liquidity tides turn (expected 1H23).

GPT3: Having been through many bubbles over my 50+ years of investing, about 10 years ago I described what in my mind makes a bubble and use that to identify them in markets. All markets, not just stocks. I define a bubble market as one that has a combination of the following in high degrees: High prices relative to traditional measures of value (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates). Unsustainable conditions (e.g., extrapolating past revenue and earnings growth rates late in the cycle when capacity limits mean that that growth can't be sustained). Today, with those and other developments in the market (e.g., meaningful decline in frothy retail activity, meaningful deterioration in sentiment), the emerging tech stocks no longer appear to be in a bubble, but neither do they appear to have substantially swung to the opposite extreme, so its not necessarily true that now is a good time to buy them. The first shows the bubble gauge/indicator going back to 1900 for the US equity market as a whole currently at the 40th percentile. How High Are Prices Relative to Traditional Measures? The current read on this price gauge for US equities is around the 50th percentile.

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in the previous Curation

CrowdCent + SumZero Baskets & Dashboard - check out a video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com).

CrowdCent Thoughts & Predictions

Check out below for some updated thoughts on the next decade. These thoughts update/build upon our previous predictions, which you can find below:

Some updated thoughts:

Overall

We’ve been risk-off in our views since the liquidity peak (~Feb 2021) and will remain so until it becomes clearer the Fed is set to pivot (i.e. liquidity bottoms and begins to reaccelerate y/y).

Many assets are starting to look quite attractive, and we think duration and liquidity-driven types should bottom in the coming 6-9 months. Cyclical and commodity types peaked later and likely bottom later – but we expect these “real assets” will be the more consistent outperformers over the next decade.

This economic slowdown is likely to be met with a Fiscal response in ~2023 - which will spur the next bull market focused on building “real” things (some trends noted below).

Central Banks

Central Banks around the world (ex PBOC) are tightening into an economic slowdown to attempt to reduce high inflation – which was exacerbated by the Russia/Ukraine invasion (next risk would be China/Taiwan). The issue with tightening is how levered the system is – notably in Europe, Japan, and the US – post the massive COVID stimulus printing (on top of the previous several decades of printing).

Net net, we’ve come to a head where both the long term and short term debt cycles are meeting (at the same time as a 4th Turning - tend to coincide). The Central Banks will have a choice between loosening into an inflation spike – risking inflation going higher / remaining persistent – and tightening into an economic slowdown – risking a Sovereign Debt bubble burst (yields up, most assets down) and system collapse.

As the ECB has shown, they are likely to do whatever it takes to preserve the current system – i.e. they will opt for printing money rather than a collapse. But that doesn’t mean there won’t be pain in the meantime – we expect a Fed pivot likely late 2022 or early 2023; for now, they are happy with the reverse wealth effect.

Progression of Market Sell-off

Liquidity Peak (Feb 2021)

Liquidity (monetary printing) driven things like ARKK and crypto generally ~peaked around here and are now down ~70-90%

Inflation Shock (Nov 2021)

Long duration assets began to rollover here, as the market began to price in higher expected inflation and the Fed began tightening in earnest

Growth Slowdown (~Jun 2022)

We are starting to see real economic growth decelerate at a faster rate as Central Banks tighten into a slowdown. China is the lone exception (loosening + economy ~bottoming), but we will see how long that lasts and the impact.

Contraction/Bottom (~1H 2023)

Expect to see a large deceleration in real global growth in 4Q22 and into early 2023. We expect this will drive the Fed to pivot on tightening (at least rate hikes) and lead to a bottom in many of the assets that started the sell off (liquidity/duration) as well as eventually cyclical types.

Inflation

We called out real world inflation in June 2020 as becoming a likely issue in 2021+

Now that the first phase of that inflation spike has played out and is well understood, we now expect inflation (y/y rate of change) will be ~peaking over the coming months

Russia/Ukraine exacerbated the initial inflation spike (which likely would have peaked out in ~March/April 2022

China/Taiwan is the next risk that could lead inflation to stay higher for longer and tie the Fed’s hands

Over the next decade, we expect inflation will be structurally higher than the previous decade – likely averaging something closer to 3-4% (versus 1-2% the previous decade).

But it will NOT be a straight line; base effects matter – 2023 is more likely to see disinflation (i.e. inflation slowing on a y/y basis, toward 2%).

USD System

Tying into Luke and Lyn’s pieces, we continue to think we are at or approaching the end of the globalized USD-centric petrodollar system we’ve been in for the last ~50 years (full thoughts in our original predictions). The West’s freezing of Russian foreign reserves accelerated this view. The breakdown of the EUR and JPY highlight how fragile the system is.

The next iteration, which we are currently transitioning to, is a more regionalized system where countries don’t just trade in USD but in local currencies (i.e. Russia trades with China in ruble and yuan, not just USD).

The “backing” of this system is still up for debate. Russia is attempting to shift back to a commodity (energy) and gold backed system – forcing those who want Russian oil to pay for it in Russian rubles. The strength of the Ruble (from 120 to now 50 vs. USD) highlights the importance of energy – you can print paper bills, but you can’t print oil.

And China is also pushing for an end to USD hegemony, as they build out their own digital currency and push for a basket of currencies to back trade.

The bancor, suggested by Keynes in the 1940s, was prescient… A basket approach, mixed in with gold-backing (and potentially something like Bitcoin, down the road) and eventually central bank digital currencies is likely the end game over the next decade.

Major Trends

Deglobalization

Reshoring & subsequent Automation

Reshoring is being accelerated by Russia/Ukraine and hedging against something like China/Taiwan. COVID highlighted how fragile our current supply chains are and how reliant the

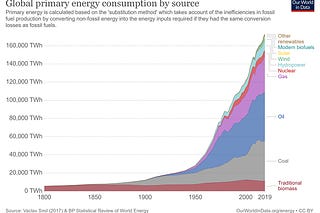

Energy Transition

Shift from fossil fuels toward alternative energy. It will continue to be a bumpy and inflationary road. There is not enough supply growth on the legacy side (fossil fuels), and battery technology (notably storage) still needs further improvements and investments on the next-gen side. Energy is the key input into the physical system (‘energy is life’) - so it is critical to watch and ideally reduce the overall cost of it.

CrowdCent Site Updates

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason, Ryan, & Carlo

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link