Discover more from CrowdCent Curation

CrowdCent Curation - No. 40

ESG, Fossil Fuel Boom, & Petrodollar Issues; Community, AI, & Web3; Crypto Bezos

Hope you’re all enjoying the weekend! There’s a lot of content in here today, but all very important. Worth the read… Enjoy and be sure to sign up for the new CrowdCent products (info below):

Active discussion - chat

CrowdCent on Twitter - link

CrowdCent Vision - here

CrowdCent ML Model - analyzer

CrowdCent Curation - archive

“That's the whole secret: to do things that excite you.” - Ray Bradbury

Translation: Easier said than done, but great advice. In a world that’s constantly changing, with endless stimulation and shrinking attention spans, it’s very easy to get caught up in all the short-termism. It’s very easy to just do things for the money (quick buck) or because it’s easy/comfortable (path of least resistance). But doing things you are passionate about can be very rewarding. It’s typically easy to tell when someone has found that overlap (passion/'occupation’) — the product is simply better (quality, attention to detail, etc.). The buildout of web3 (which we detail below) should help enable entrepreneurs to build things they are passionate about and get compensated accordingly. A shift away from centralized behemoths + price-gouging middlemen, and toward decentralization + power to the individual/community. It’s a massive change in power structure and value capture; incentives are aligned — use it to do what motivates you.

Finance

Will ESG Create The Next Lehman Moment...??? [Post]

Recap: Kuppy provides some context around the 'energy shortage' headlines (UK gas pumps dry, China orders firms to acquire energy supplies at all costs) you are seeing around the world. This isn't a "one-off," but rather a situation created by a multitude of factors — maybe most notably, the ESG initiative (dubbed “energy [supply] stopped growing”).

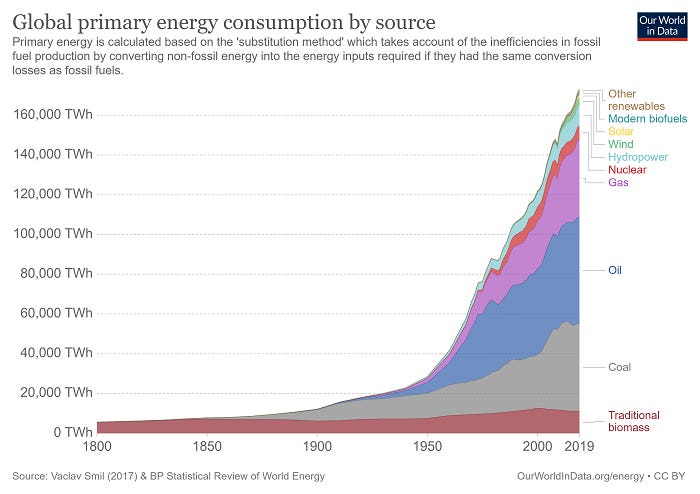

Comment: The current shortages of oil and gas are a classic example of supply and demand at work. Supply is being constrained by government-driven ESG initiatives (i.e. investment restrictions, carbon taxes, drilling moratoriums). While demand continues to grow as economies reopen, populations (modestly) grow, and the global standard of living inches higher (i.e. consume more energy). Lyn Alden clearly lays out the demand side over time here (see image below) — ‘previous energy sources remain flat or even continue to grow in absolute terms, while the new one grows faster.’ Ultimately, with limited additional supply, and growing demand, the clearing price goes up — likely the last big fossil fuel boom…

But this is all bigger than that. It is all part of a larger global power struggle. The current petrodollar system (i.e. dollar backed by oil) simply explained, courtesy of George Gammon — ‘The Saudis would price their oil in dollars and re-invest the dollars into U.S. Treasury securities and Eurodollar deposits in U.S. banks. In exchange, the U.S. would stabilize the exchange value of the U.S. dollar and agree to sell advanced weapons to the Saudis.’ As we’ve noted, this petrodollar system is fraying (worthwhile read here), so the USD, on the margin, continues to lose power (i.e. less people use for transactions, lower network effects). The US knows the next energy system will be based on semiconductors, rare earth minerals, and battery materials — and like all countries, they want energy independence and control, hence Biden’s executive order on supply chains… But it’s a tough needle to thread — transitioning from fossil fuels to alternative energy, while maintaining power and global reserve currency status (as you shift away from the thing, oil, ‘backing’ your currency position) — particularly given leverage in the current system. Simultaneously, China is paying for oil in non-USD, just banned crypto (because they can’t centrally control it) and is about to massively expand the launch of the digital yuan (CBDC they control). Overall, we are at a critical transitional juncture with the erosion of the petrodollar system, and the convergence of alternative energy and crypto (e.g. CBDC) as part of the next system — the moves are likely to be nonlinear as part of this complex network. 'Show me the incentives, and I'll tell you the outcome.'

Blockchain

Community, AI & Web3 [Tweet]

Recap: Raoul with a great thread on the power of communities, particularly when paired with two critical enabling technologies (AI & Blockchain - foundations for web3) — 'movement towards Web 3.0 and communities with open access to information has super-empowered community decision making... Combining communities with AI and giving the information back to the community in order to enable better decision making is powerful and the antithesis of the extractive business models of existing platforms that use AI to monetize your attention.'

Comment: A must read short thread that succinctly summarizes CrowdCent's Vision. With web3 (great, quick description by Chris Dixon) hitting the kink in the S-curve (useful Dune Analytics dashboard) and the extraordinary (and accelerating) capabilities of AI/ML, everything is changing — creators compensated for content, trapped data unlocked as insights returned to users, communities capturing created value, middlemen disintermediated. Communities have always existed (humans are social animals), but were hyperlocal pre-Internet. The current mature iteration of the Internet (web2) is dominated by centralized behemoths (e.g. FB, GOOG) that capture a large chunk of value (you are the product — watch The Social Dilemma if you don’t believe us). Blockchain is the enabling technology that changes this; the future is decentralized. Here is a great example of one of many use cases: CrowdCent and Numerai building a decentralized hedge fund run by data scientists around the world — but this is just the beginning. Consumers are naturally attracted to and recognize value — this revolution will be exponential.

Technology

Crypto Bezos [Post]

Recap: Excellent thought-piece that delves into what Jeff Bezos would build if he were just getting started today. When he started Amazon, he recognized the Internet as a revolutionary enabling technology that could be used to better serve customers. He knew what the Internet could help with, and what it couldn't. The Internet itself was NOT his value proposition, but rather it was simply a tool that helped him create a better value proposition (i.e. better selection, lower cost) for customers (his focus). Today, he would likely look at blockchain and web3 through the same lens — how could I better serve customers + create value using this enabling technology?

Comment: There are quite a few great Not Boring pieces, but this may be the best thus far. Using the Internet / Amazon in 1994 analogy provides a useful historical framework — enabling technology hitting escape velocity + entrepreneurs utilizing new tech to build better businesses — for where we are in the blockchain revolution and how to think about utilizing/capitalizing on it. The most important takeaway may simply be: blockchain is an enabling technology and we are in the midst of a critical category creation period; what can you build new/better with this tool? It’s time to build. This all ties nicely into the Community, AI, & Web3 comments above... high quality data, paired with domain expertise, ML, and blockchain = powerful recipe.

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

CrowdCent ‘dapp’ on Numerai - check out the update here, the post here, and commentary in the earlier Curation

CrowdCent + SumZero Baskets & Dashboard - check out a video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

Email us at info@crowdcent.com for more info.

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com) and/or check out the free private beta here.

You simply submit the idea (no public posting necessary), and receive a full model-generated analysis!

CrowdCent Thoughts & Predictions

In keeping with the 6-month updates, see here for our most recent tracking update (6/20/2021) from CC’s predictions on 6/7/2020 - original here (6/7/2020), 6mo update here (1/3/2021).

For more frequent updates and the most up-to-date thoughts, be sure to create a free CrowdCent account and join the Telegram!

CrowdCent Site Updates

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason & Ryan

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link

Subscribe to CrowdCent Curation

Curated content across Finance, Blockchain, and Technology