Discover more from CrowdCent Curation

CrowdCent Curation - No. 45

CrowdCent Snapshot, Numerai's Success, & Generative AI's iPhone + App Store Moment

Hope everyone is enjoying the weekend! Apologies for the hiatus; we’ve had a lot going on (in a good way) and have a pipeline of products and announcements on the way.

This week, we focus on the biggest innovation in a decade – generative AI, specifically Large Language Models (LLMs) and the emerging ecosystem being created. And in the coming weeks we’ll provide a refresh of our next decade thoughts (original post; see below ‘Thoughts and Predictions’) and check out how our predictions are doing.

Tomorrow we’re hosting a Twitter Spaces at 12:30pm ET - join us CrowdCent Curation - Live!

The focus will be primarily on the massive acceleration of innovation in the generative AI ecosystem – we think ChatGPT was the iPhone moment, and plug-ins are the iOS App Store moment…

Another great quarter under SZ Strategies belt – and now new and improved models are on the way

For a snapshot of how it works, return info, ideas selected, and our latest macro commentary – read the 4Q22 Summary Report and check out these threads CC thread + SZ thread

CrowdCent Alpha - ChatGPT meets Warren Buffet. An investment ‘oracle’ in many ways, and eventually an essential tool in every investor’s toolkit. Coming soon…

Join our active Telegram chat & follow us on Twitter for our latest thoughts & updates

“One man with conviction will overwhelm a hundred who have only opinions.” - Winston Churchill

[When you have conviction…]

“Put all your eggs in one basket and watch the basket carefully.” - Mark Twain

Translation: Many people are a mile wide and an inch deep on most subjects – opinions on everything, but conviction in nothing (#JimCramer). And many fail to ever really find their Ikigai. Years ago, we found ours at the convergence of NLP/AI, investing, and blockchain – hence the birth of CrowdCent. We have been working on the NLP/AI side of things for years, expecting this eventual ChatGPT-like moment (admittedly, we didn’t know what the spark would be). The progress behind the scenes on the AI front (e.g. OpenAI) has been astounding, but most had no real tangible way to truly understand what we were so excited about. Then along came ChatGPT (iPhone moment) + plug-ins (iOS app store moment) revealing what has been going on in the background in a more consumer understandable way. We have conviction in the generative AI boom; we are going to use it to help accelerate the transformation of the outdated, unequally distributed legacy investment industry. The future is here. Pay attention.

Finance

Crowdcent - NLP Meets Decentralized Investing [Post]

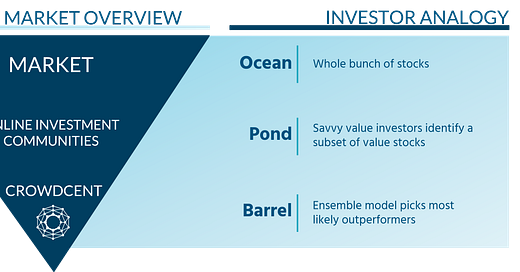

Recap (GPT4): CrowdCent is a platform that combines natural language processing (NLP), machine learning (ML), and decentralized investing to provide a data-driven and automated approach to portfolio management. It encodes the knowledge of investment communities into data, and combines it with fundamental and other financial data about assets. The AI algorithm (meta-model) is trained on this data to act as a portfolio manager, selecting promising investment opportunities. This approach is more data-driven, scalable, and transparent than traditional investment management. CrowdCent's innovation sits at the intersection of NLP, ML, and decentralized investment management – highlighting the potential for disruption in the investment management industry.

Comment: The article above provides a great snapshot of what we’re working on at CrowdCent, and Jason delves into some details on how we are using NLP/ML tech in this recent video with SumZero’s Divya Narendra (4:09 mark), as well as in this throwback podcast (we’ve been excited about this for a while…). Net net, we are at an inflection point on the tech side – things are improving at an exponential rate. Definitely worth listening in on our Spaces tomorrow to hear more about the generative AI landscape, how we are using it, and how you can use these new emerging tools.

Blockchain

Numerai Returns 20%, Raises Another $100M [Article]

Recap (GPT4): Numerai is a San Francisco-based hedge fund that uses a unique, AI-driven approach to gather trading ideas from non-finance professionals (primarily data scientists). The fund has seen significant success, managing nearly $300 million and returning 49% since its inception (including 20% last year, despite the market turmoil). Numerai provides users with abstracted data, to derive trading ideas based on statistical patterns. The platform rewards contributors with its native cryptocurrency, Numeraire (NMR), and aims to reach $1 billion in AUM.

Comment: CrowdCent is a major contributor (the largest) to Numerai’s tournament, the results of which help drive Numerai’s hedge fund investments. We love seeing the success of the ‘real-world’ Numerai hedge fund, as it gives credence and legitimacy to the decentralized investment management approach – i.e. if you know what you’re doing, it works. While Numerai is focused primarily on data scientists, CrowdCent has a similar vision, but is focused on non-data scientists as well – anyone who has an investment idea can participate (no data science or coding necessary). With both our success in Numerai’s tournament, as well as SZ Strategies the CrowdCent track record continues to build – more to come!

Technology

Who Owns the Generative AI Platform? [Article]

Recap (GPT4): The article examines the generative AI tech stack, focusing on startups developing foundation models (e.g. OpenAI), AI-native apps, and infrastructure/tooling (e.g. AWS, Azure). It addresses the key question of where value will accrue in this market, as infrastructure vendors have captured most value so far. The article raises questions about cloud providers' ability to create stickiness and the potential for challenger clouds to break through. The uncertainty surrounding where value will accrue in the generative AI market is seen as good news, as the market's potential size is enormous, and the authors expect many players, healthy competition, and both horizontal and vertical companies to succeed.

Comment: The above a16z article combined with this piece on the history of the generative AI landscape provide a great combination to get up-to-speed on what’s going on in the AI universe. And if you want to take it a step further, check out this video to see how you can use these tools in your life, job, etc. As you can likely tell, we are incredibly excited about these developments and the productive applications to come… This is AI’s iPhone + app store moment.

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

CrowdCent Alpha - ChatGPT meets Warren Buffet. An investment ‘oracle’ in many ways, and eventually an essential tool in every investor’s toolkit. Coming soon…

SZ Strategies - this CC thread + SZ thread provide great summaries of the process and the product. Check out the video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in the previous Curation

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com) and/or check out the free private beta here.

CrowdCent Thoughts & Predictions

Check out below for some updated thoughts on the next decade. These thoughts update/build upon our previous predictions, which you can find below:

For our latest macro & market thoughts, check out our quarterly update:

CrowdCent Site Updates

Check out the new landing page, about, mission, and vision

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason, Ryan, & Carlo

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link