Discover more from CrowdCent Curation

CrowdCent Curation - No. 44

Economic Framework, Energy vs. Sovereign Debt, & US/China Cold War 2.0

Hope everyone is enjoying the weekend! Check out the updates, upcoming events (today), and content below:

Today we’re hosting a Twitter Spaces at 12pm ET - join us CrowdCent Curation - Live!

We’ll discuss the Macro & Investing landscape, recent Curation content, new product launches, and more!

In partnership with SumZero, we just launched SZ Strategies

We use our quantitative models (powered by cutting-edge AI & NLP technology) to select ideas from SumZero's vast database of investment research that have the potential to generate superior returns – with almost 3 years of out-of-sample results, so far, so good!

For a snapshot of return info, ideas selected, and our latest macro commentary – read the 3Q22 Summary Report

Finally, this CC thread + SZ thread provide great summaries of the process and the product – accessible to everyone, today!

We gave our landing page a makeover - let us know what you think!

With all the updates, we refreshed our Mission - quick, useful read

Finally, join our active Telegram chat & follow us on Twitter for our latest thoughts & updates

“Simple is not the same as easy. The ability to simplify is incredibly hard, but very powerful.” - CrowdCent

Translation: People often confuse the terms simple and easy. But they are very different. You must truly understand a topic to explain it in simple terms (‘If you cannot explain something in simple terms, you don't understand it’ - Feynman). It takes years of hard work, focus, and discipline to master a subject and/or a skill – only then can you truly distill something complex into something simple… This is both part of our:

Finance

Prometheus Podcast: Eric Basmajian [Podcast]

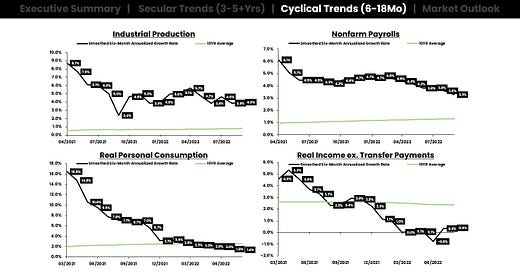

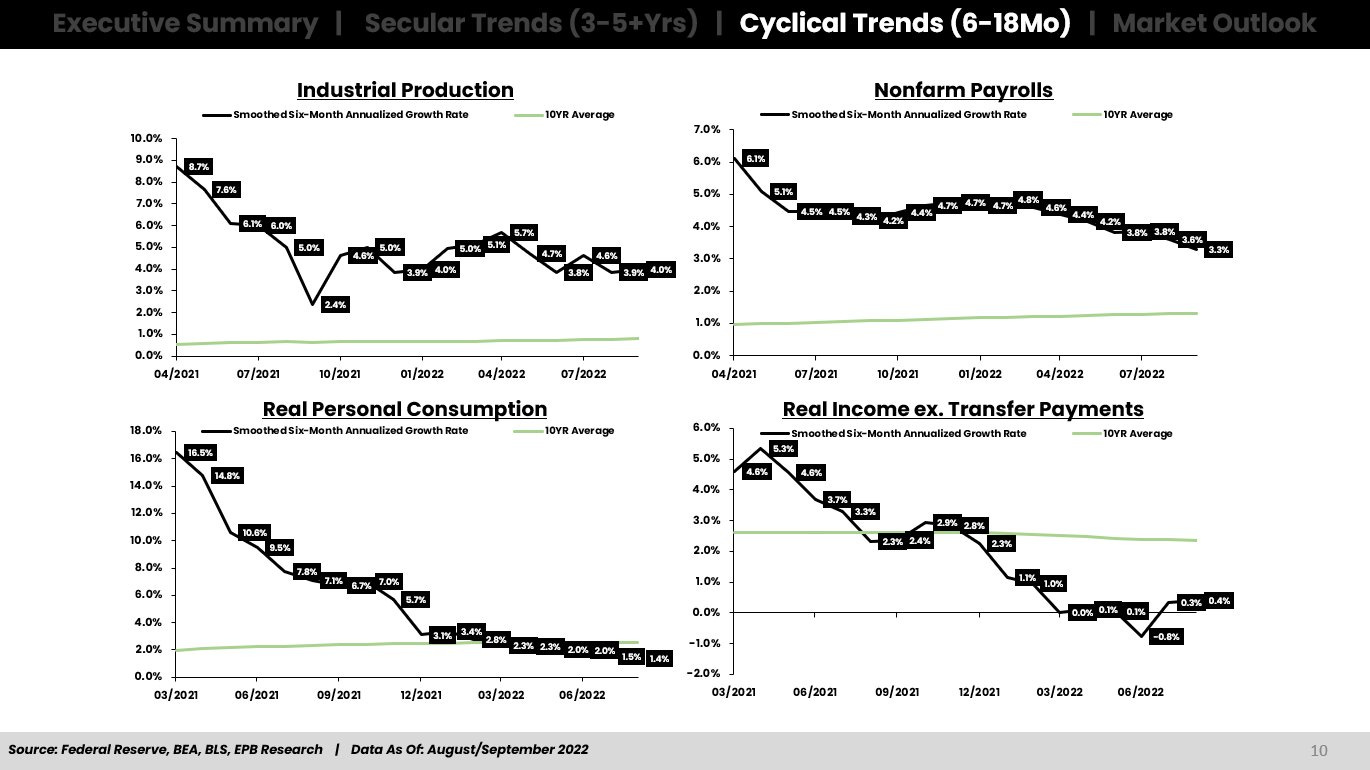

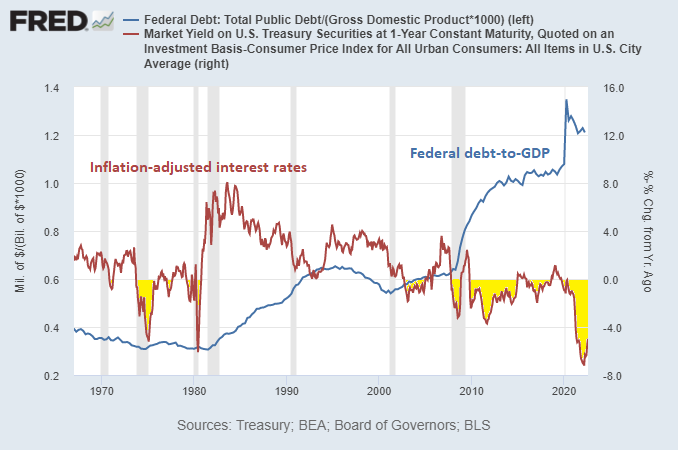

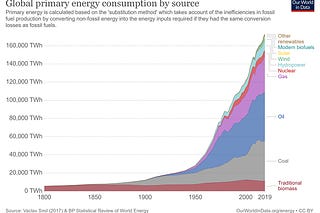

Recap: In this interview, Eric walks through his economic framework, the rationale behind it, and where he thinks we are today. From a financial/macro perspective, we are well on our way toward a recession – as we have already begun to see housing slow (step one), new orders fall (step two), and we’re beginning to see dents in production (step three), with the last shoe to drop being employment (step four). The drivers of inflation and its cyclicality are Money (Fed/Treasury/Banks print money from nothing) → Price (prices in the economy go up where there are supply/demand mismatches) → Wage (workers demand higher wages to afford the new higher prices). The Fed is attempting to break that cycle by now draining money and raising it’s cost (i.e. interest rates) – the tricky thing about this cycle is we are past peak cheap energy (Russian energy leaving global market) and past peak cheap labor (China no longer manufacturing hub; overall labor force smaller), and the system is heavily indebted (cannot handle high/positive real rates).

Comment: In addition to a great podcast, Eric has put together some very useful (and quick) intro videos over the past few months – from his economic framework, to a housing analysis (with a focus on ‘22/’23), to an updated US demographic analysis, and finally how recessions typically end inflation. These short videos help answer a lot of burning current questions and are must watches. Even if you don’t agree with his conclusions, there is a lot to learn from the process...

Macro / Blockchain

October 2022 Newsletter: Energy vs Sovereign Bond Markets [Post]

Recap: Lyn does a great job summarizing the current macro landscape and updating her views on the popping of the sovereign debt bubble, and why energy supply shortages are the main lynchpin in the system. Simplistically, there is not enough energy supply to handle current global demand – hence why Central Banks are tightening around the world to reduce demand (i.e. remove liquidity, create a recession). But they are hamstrung by the current amount of debt in the system – they can’t raise rates too much, or the system implodes (interest rates go up and debt becomes unaffordable). We saw glimpses of this in England, when the BoE had to step in and start doing QE (i.e. printing money to buy bonds) to save the pension system. In addition to Lyn’s piece, there have been several great recent podcasts – Kuppy on why oil is the global central banker, along with Luke on how the USD fits into the global energy crisis – on how the energy crisis is and will exacerbate the macro/financial market issues we face today. What we really need is an energy supply response and politicians don’t quite seem to understand that yet...

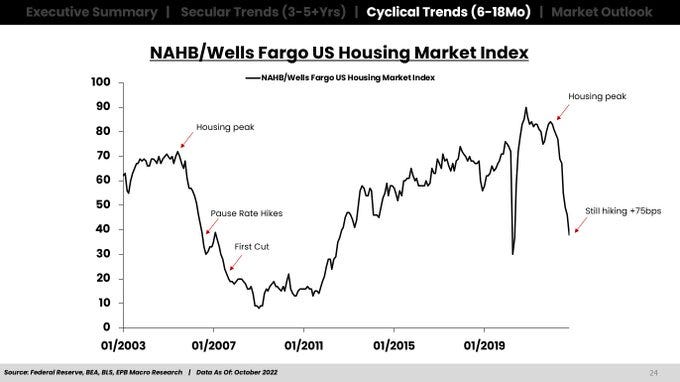

Comment: As we’ve mentioned in several of our newsletters, energy and finance are closely intertwined. Over the last few decades (particularly the last), we have not had to worry about cheap labor (dismantled USSR + China into WTO provided that) or cheap energy (dismantled USSR and US fracking provided that). With the rising WW3 tensions (Russia/Ukraine + China/Taiwan), both labor and energy costs are rising – which is extremely disruptive to a heavily indebted financial system. Our concern over the coming months is – as we see the SPR release slow and China eventually reopen, we are likely to see a spike in the cost of energy (notably oil). This will exacerbate inflationary pressures at the same time we are seeing slowing economic growth (earnings downgrades, etc.), so Central Banks will be forced to stay tight into a slowdown. The final reaction function is likely a progression of SLR relief in the US (i.e. let banks buy more bonds) and an eventual form of yield curve control… followed by more targeted potential direct fiscal stimulus next summer as the Fed launches FedNow – it’s new payment system (and a step toward central bank digital currency).

Technology

China & Semiconductors [Video]

Recap: In this short video, Zeihan walks through the implications of the recent semiconductor restrictions the US put on China. The net of it – this is a significant escalation. The US is using its semiconductor IP as a weapon to deter China from taking Taiwan and likely from reopening – which would cause an oil price spike (a serious issue for a levered system, as noted above). Overall, these semiconductor export restrictions set back China’s semiconductor industry years (likely decade+) and will dramatically hamper their AI/military capabilities (need the leading edge inputs). For a supplement to the video, this thread is a great summary of the restrictions/implications. And if you want to better understand the semiconductor landscape and how it has evolved + how China fits in, check out these two recent pieces: China and USA Are Officially At Economic War and Chips & China.

Comment: We have talked a lot about the significance of semiconductors in our past newsletters, our chat and in our decade predictions (check out links, below) – we believe semiconductors are the new oil, and are a key advantage and bargaining chip for the US. Over the last 40+ years, the world has built a very efficient global supply chain – with WW3 (cold and/or kinetic), this is broken. Over the next decade+, we will need to rebuild into regionalized supply chains (notably semiconductors, battery materials) and this will drive a significant capex boom – bringing back things like semiconductor manufacturing & battery plants to the US and West. And remember, war and pandemics are inflationary – a new system is likely afoot.

CrowdCent Products

CrowdCent is building out several new products, many of which you can test out today (email us: info@crowdcent.com):

SZ Strategies - this CC thread + SZ thread provide great summaries of the process and the product. Check out the video of Jason explaining how CrowdCent is training ML algos with SZ ideas to build investment portfolios here. For a more detailed read, check out the whitepaper here.

CrowdCent ‘dapp’ on Numerai - check out the post here, and commentary in the previous Curation

CrowdCent Analyzer - Want to get feedback on an investment idea? See what a trained machine learning model thinks of your idea (the probability of under/outperformance)? Email us (info@crowdcent.com) and/or check out the free private beta here.

CrowdCent Thoughts & Predictions

Check out below for some updated thoughts on the next decade. These thoughts update/build upon our previous predictions, which you can find below:

For our latest macro & market thoughts, check out our quarterly update:

CrowdCent Site Updates

Site continues to expand, check out crypto-asset posts here: ETH, BTC, NMR, CRV/UNI/BAL

Any suggestions for CC Curation improvement, website, etc. - send an email to info@crowdcent.com

Look forward to more updates soon - the future is here...

Best,

Jason, Ryan, & Carlo

Website: CrowdCent

Twitter: @CrowdCent

Telegram: Link